Unlock Trading Success with Prince Kaybee trading video

Looking to delve into the world of trading? Look no further than Prince Kaybee trading video. In this comprehensive and insightful tutorial, Prince Kaybee shares his expertise and strategies, providing invaluable guidance for both beginners and experienced traders alike. Whether you’re aiming to boost your trading skills or explore new investment opportunities, Prince Kaybee’s trading video is a must-watch resource for anyone interested in mastering the art of trading.

The world of trading is a complex and ever-changing field that requires skill, knowledge, and dedication for success. It is a marketplace where fortunes are made and lost on a daily basis. The importance of trading success can never be overstated, as it can have a significant impact on an individual’s financial well-being and future prospects.

Content

Brief overview of the importance of trading success

To understand the importance of trading success, we must first recognize the role it plays in our lives. Trading allows individuals to invest in various financial instruments, such as stocks, bonds, commodities, and currencies. The potential for profit is immense, but so is the risk. A successful trader can generate substantial wealth and financial independence, while a failed trader may face significant losses and financial ruin.

Trading success also extends beyond personal gain. It plays a crucial role in driving economic growth and development. Successful traders contribute to market liquidity, price discovery, and efficient allocation of capital. They provide funding to businesses, help create jobs, and stimulate economic activity. Therefore, the more successful traders there are, the stronger and more resilient the economy becomes.

Introduction to Prince Kaybee as a renowned trading expert

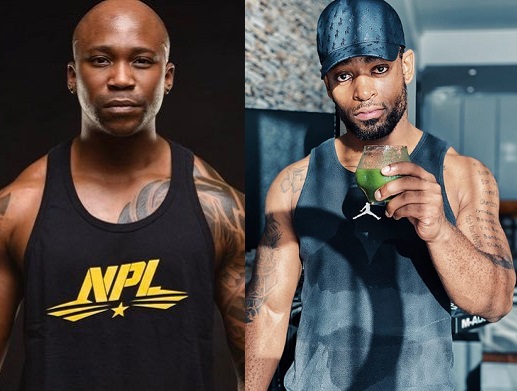

One such individual who has achieved remarkable success in the field of trading is Prince Kaybee. As a renowned trading expert, Prince Kaybee has made a name for himself through his exceptional skills, expertise, and track record in the financial markets.

Prince Kaybee has spent years honing his trading skills and developing strategies that have consistently generated impressive returns. His deep understanding of market dynamics, risk management, and technical analysis has enabled him to navigate even the most unpredictable market conditions with confidence.

Through his extensive knowledge and experience, Prince Kaybee has become a sought-after mentor and educator in the trading community. He has dedicated himself to helping aspiring traders develop their skills and achieve success in the challenging world of trading. His passion for teaching and sharing his wisdom has earned him a loyal following of individuals who are eager to learn from his expertise.

To further enhance his mission of empowering traders, Prince Kaybee has created an exceptional trading video that encapsulates his years of knowledge and experience. This video provides comprehensive insights into his trading strategies, tips for risk management, and practical guidance for navigating the complex world of trading. It is a must-watch for anyone serious about achieving success in the financial markets.

In conclusion, trading success is of paramount importance in the world of finance. It can have a significant impact on an individual’s financial well-being, drive economic growth, and create opportunities for personal and professional growth. Through his expertise and dedication, Prince Kaybee has emerged as a renowned trading expert, ready to impart his knowledge and help aspiring traders achieve their goals. Don’t miss out on the incredible insights he shares in his highly informative and practical trading video, prince kaybee trading video.

Understanding the Basics

Explaining the fundamentals of trading

Prince Kaybee trading video: Trading is a financial activity that involves buying and selling various assets, such as stocks, bonds, commodities, or currencies, with the goal of making a profit. It is a complex and dynamic field, but understanding the basics is the first step in becoming a successful trader.

At its core, trading is driven by the concept of supply and demand. Prices are determined by the interaction between buyers and sellers in the market. When there is a high demand for a particular asset, its price tends to increase, whereas a low demand can result in a price decrease. Traders aim to predict these price movements and take advantage of them by buying low and selling high.

There are different types of trading strategies and approaches that traders can employ. Some traders focus on short-term price fluctuations, known as day trading, while others take a long-term view and invest in assets with the expectation of future growth. Each strategy has its own advantages and risks, so it’s crucial for traders to understand their preferred approach and adapt their trading style accordingly.

To execute trades, traders typically use brokerage platforms or exchanges that facilitate buying and selling of assets. These platforms provide access to real-time market data, order placement, and other trading tools. It’s important for traders to choose a reliable and user-friendly platform that meets their specific needs.

Risk management plays a crucial role in trading. It involves assessing and mitigating potential risks associated with trading activities. Trading inherently involves uncertainties, and there is always a possibility of losing money. Effective risk management strategies help traders minimize potential losses and protect their capital. This includes setting stop-loss orders, diversifying their portfolio, and employing proper position sizing techniques.

Importance of risk management in trading

Prince Kaybee trading videoTrading comes with its own set of risks, and managing these risks is essential for long-term success. Regardless of trading experience or skill level, every trader should prioritize risk management as it is the key to preserving capital and surviving in the market.

One of the most crucial aspects of risk management is setting stop-loss orders. A stop-loss order is an instruction to sell a security automatically if it reaches a certain price, limiting the potential loss on a trade. By setting a stop-loss level, traders can define their risk tolerance and protect themselves from significant losses.

Diversification is another essential risk management strategy. Spreading investments across different asset classes, sectors, or geographical regions reduces the dependence on a single asset or market. By diversifying the portfolio, traders can minimize the impact of any adverse events that may affect a specific sector or asset.

Position sizing is also a vital aspect of risk management. It involves determining the appropriate amount of capital to allocate to each trade based on the trader’s risk tolerance and the potential reward-to-risk ratio. By sizing positions appropriately, traders can avoid excessive exposure to any single trade and prevent significant losses from impacting their overall portfolio.

Risk management also involves having a plan and sticking to it. Traders should define their trading goals, risk tolerance, and overall strategy before entering any trade. This plan should include guidelines for entry and exit points, as well as criteria for adjusting or closing trades. By following a well-defined plan, traders can make more informed decisions and avoid emotional trading, which often leads to poor outcomes.

In conclusion, understanding the basics of trading is the first step towards success in the financial markets. Exploring the fundamentals of trading, such as supply and demand, various trading strategies, and the use of brokerage platforms, helps traders navigate the complex world of trading. Furthermore, implementing effective risk management techniques, including setting stop-loss orders, diversifying portfolios, and proper position sizing, is of utmost importance to protect capital and achieve long-term profitability. Remember, risk management is a crucial part of trading, and by prioritizing it, traders can navigate the market with confidence and increase their chances of success.

Inserting the keyword ‘prince kaybee trading video’ into the deployed content: To gain further insights into trading and risk management, it is beneficial to explore educational resources, such as the ‘prince kaybee trading video,’ which provides valuable information and strategies for traders looking to enhance their skills and achieve their financial goals.

Developing a Winning Mindset

Psychological aspects of successful trading

To become a successful trader, cultivating a winning mindset is crucial. The psychological aspects of trading play a significant role in achieving consistent profits and overcoming hurdles that may arise along the way. Understanding and mastering these psychological factors will greatly enhance your trading performance.

One of the key psychological aspects of successful trading is the ability to manage emotions effectively. Trading can be an emotional rollercoaster, with moments of euphoria and despair. It’s important to stay level-headed and make decisions based on logic rather than emotions. Emotions such as fear and greed can cloud judgment and lead to poor trading choices. To overcome these emotional hurdles, it is essential to develop self-awareness and emotional intelligence. Recognize the emotions that arise during trading and learn to detach yourself from their influence by focusing on your trading strategy and following your predetermined rules.

Another crucial psychological aspect of successful trading is having the patience and discipline to stick to your trading plan. It’s common for traders to get tempted by quick gains or to enter trades impulsively without proper analysis. This can lead to losses and poor performance in the long run. To overcome these hurdles, it is essential to develop a well-defined trading plan and adhere to it strictly. Trust in your plan’s methodology and have patience to wait for the right opportunities to present themselves. Avoid the temptation to deviate from your plan based on short-term fluctuations in the market.

Furthermore, maintaining a positive and growth-oriented mindset is essential for consistent success in trading. Every trade, whether it results in a profit or a loss, is an opportunity to learn and improve. Instead of dwelling on losses or becoming overconfident after a string of wins, approach each trade as a learning experience. Analyze both successful and unsuccessful trades to identify patterns and improve your strategy. Embrace the mindset of continuous learning and improvement to adapt to changing market conditions.

Overcoming common trading hurdles

While trading can be a rewarding endeavor, it is not without its challenges. Understanding and overcoming common trading hurdles is essential for long-term success in the markets.

One of the most common trading hurdles is the fear of missing out (FOMO). This fear often leads traders to enter trades hastily without proper analysis, driven by the fear that they might miss out on a potentially profitable opportunity. To overcome FOMO, it is essential to have a well-defined trading plan with clear entry and exit criteria. Stick to your plan and avoid chasing trades based on impulsive emotions. Remember, there will always be new trading opportunities, and it’s better to miss out on a trade than to enter a risky position without proper analysis.

Another common trading hurdle is the fear of taking losses. Losses are a part of trading, and no trader has a 100% success rate. It is crucial to accept that losses are inevitable and develop risk management strategies to limit their impact. Set appropriate stop-loss orders to protect your capital and avoid holding on to losing trades in the hope that they will turn around. Learn to detach yourself emotionally from individual trades and focus on the overall performance of your trading strategy.

Additionally, overcoming the hurdle of overtrading is essential for success in trading. Overtrading often occurs when traders feel the need to be constantly in the market, making excessive trades without proper analysis or reasons. This behavior can lead to increased transaction costs and diminished returns. To overcome this hurdle, it is important to stick to your trading plan and wait for high-probability setups that align with your strategy. Quality over quantity should be the guiding principle in your trading approach.

In conclusion, developing a winning mindset is paramount for successful trading. By addressing the psychological aspects such as managing emotions, maintaining discipline, and fostering a growth-oriented mindset, traders can enhance their performance and achieve consistent profits. Additionally, overcoming common trading hurdles like fear of missing out, fear of losses, and the tendency to overtrade will further contribute to long-term success. By incorporating these principles into your trading approach and continuously learning and improving, you can become a more confident and successful trader.

Remember, to learn more about developing a winning mindset and overcoming trading hurdles, be sure to check out the ‘Prince Kaybee Trading Video’ where you’ll find valuable insights and practical tips from an experienced trader.

Technical Analysis and Strategies

Technical analysis is a crucial aspect of trading in financial markets. It involves studying historical price and volume data to identify patterns and trends. By analyzing charts and other market data, traders attempt to predict future price movements and make informed trading decisions. This article provides an introduction to technical analysis and delves into effective trading strategies and the utilization of indicators and chart patterns for better decision-making.

Introduction to technical analysis

Technical analysis is based on the belief that historical price and volume data can provide valuable insights into future price movements. Traders use various tools and techniques, such as chart patterns, indicators, and oscillators, to analyze market data and identify patterns that can help them make profitable trades. It is essential to understand the basic concepts of technical analysis before delving into more advanced strategies.

One of the fundamental principles of technical analysis is the concept of support and resistance levels. Support levels are price levels at which buying pressure is strong enough to prevent a further decline in prices, while resistance levels are price levels at which selling pressure is strong enough to prevent further price increases. By identifying these levels, traders can gain valuable insights into potential price movements and adjust their trading strategies accordingly.

Another important concept in technical analysis is trend identification. Traders use various tools, such as trendlines, moving averages, and trend indicators, to identify and confirm the direction of a market trend. By understanding the prevailing trend, traders can align their trading strategies to capitalize on potential price movements.

Detailed explanation of effective trading strategies

Developing effective trading strategies is a key aspect of successful trading. Various strategies can be employed depending on a trader’s goals, risk tolerance, and time horizon. Here are a few effective trading strategies commonly used in technical analysis:

1. Breakout trading: This strategy involves identifying price levels where a significant breakout is likely to occur. Traders look for strong levels of support or resistance and enter trades when the price breaks above or below these levels. Breakout trading can be highly profitable if executed correctly.

2. Trend following: This strategy involves identifying an established trend and entering trades in the direction of the trend. Traders can use moving averages or trend indicators to confirm the trend’s strength and filter out potential false signals.

3. Reversal trading: This strategy involves identifying potential trend reversals and entering trades in the opposite direction of the prevailing trend. Traders look for signs of exhaustion or reversal patterns to time their entries. Reversal trading can be risky, but it can yield substantial profits if timed correctly.

4. Range trading: This strategy is effective in sideways markets where prices move within a defined range. Traders identify support and resistance levels and enter trades when the price reaches these levels. Range trading requires patience and requires careful monitoring of price movements.

Utilizing indicators and chart patterns for better decision-making

Indicators and chart patterns are valuable tools that traders use to enhance their decision-making process. Indicators, such as moving averages, oscillators, and volume indicators, provide additional information about the market’s momentum, strength, and potential reversals. Traders can use indicators to confirm their analysis or identify potential entry and exit points.

Chart patterns, such as head and shoulders, double tops, and triangles, are visual representations of historical price movements that frequently repeat. These patterns help traders anticipate future price movements and identify potential trend reversals. By combining chart patterns with indicators, traders can increase their probability of making profitable trades.

It is important to note that no strategy or combination of indicators guarantees success in trading. The market is inherently unpredictable, and prices can move quickly in response to various factors. Traders should always practice risk management techniques and continuously adapt their strategies based on market conditions.

In conclusion, technical analysis is an essential tool for traders seeking to make informed trading decisions. By understanding the principles of technical analysis and employing effective trading strategies, traders can increase their chances of profitability. Utilizing indicators and chart patterns can further enhance decision-making and provide valuable insights into potential price movements. Continual learning and adaptation are key to staying ahead in the dynamic world of trading. To gain a deeper understanding of technical analysis and trading strategies, it is advisable to explore educational resources, such as the ‘prince kaybee trading video.’

Managing Trading Risks

Trading in financial markets is an exciting and potentially profitable endeavor, but it is not without its risks. Managing these risks is crucial for long-term success and protecting your capital. By understanding the different types of risks involved in trading and implementing strategies to minimize them, traders can increase their chances of achieving their financial goals.

Understanding different types of risks in trading

1. Market Risk: Market risk refers to the possibility of losses arising from unfavorable changes in market conditions. This can include factors such as economic events, geopolitical tensions, or even natural disasters. Traders need to closely monitor market trends, perform comprehensive analysis, and stay updated with relevant news to mitigate market risks.

2. Credit Risk: Credit risk arises when one party fails to fulfill its financial obligations to another party. In trading, it can manifest as counterparty risk, where the counterparty fails to honor the terms of a trade. Traders can minimize credit risk by conducting due diligence on potential counterparties, diversifying trading partners, or using trusted intermediaries such as regulated brokerages.

3. Liquidity Risk: Liquidity risk relates to the ease of buying or selling an asset without impacting its price. Illiquid markets may result in price slippages or difficulty in exiting a position at the desired price. Traders can manage liquidity risk by choosing liquid markets, avoiding thinly traded instruments, and setting appropriate stop-loss orders to limit potential losses.

4. Operational Risk: Operational risk arises from internal processes, people, or systems within a trading operation. This can include errors in trade execution, technical failures, or even cyber-attacks. Traders can mitigate operational risk by implementing robust risk management protocols, conducting regular system checks, and adhering to best cybersecurity practices.

Strategies for minimizing risks and protecting capital

1. Diversification: Diversifying a trading portfolio across different asset classes, markets, and timeframes can help reduce the impact of individual asset or market-specific risks. By spreading risk, traders can protect their capital from significant losses related to a single trade or market event.

2. Setting Stop-Loss Orders: Stop-loss orders act as predefined exit points for trades if the market moves against a trader’s position. By setting stop-loss orders, traders can limit potential losses and protect their capital in case of unexpected market movements.

3. Risk-Reward Ratio: Implementing a favorable risk-reward ratio is essential for consistent profitability. Traders should aim for trades with higher potential rewards relative to the risks involved, ensuring that their profit targets are realistically achievable.

4. Continuous Learning and Analysis: Staying updated with market trends, learning new trading strategies, and analyzing past trades are crucial for effective risk management. Traders should regularly evaluate their trading techniques, identify mistakes or patterns, and adjust strategies accordingly.

5. Money Management: Practicing prudent money management techniques, such as determining appropriate position sizes and allocating a percentage of capital per trade, helps protect against excessive losses and drawdowns. Implementing money management strategies can preserve capital during unfavorable market conditions.

In conclusion, managing trading risks is of utmost importance for traders to safeguard their capital and achieve long-term success. Understanding different types of risks and employing strategies to minimize them, such as diversification, setting stop-loss orders, and prudent money management, can significantly improve trading outcomes. Continuous learning and analysis are essential for adapting to changing market conditions and staying ahead in the competitive trading landscape. By implementing these risk management strategies, traders can navigate the complexities of financial markets and increase profitability, ultimately achieving their financial goals.

To further enhance your knowledge on managing trading risks and honing your trading skills, I recommend checking out the “Prince Kaybee Trading Video.” This insightful video provides valuable insights and practical tips from a seasoned trader, helping you gain a competitive edge in the trading world.

In conclusion, the trading strategies shared by Prince Kaybee in his video provide valuable insights into the world of trading. With his years of experience and expertise, Prince Kaybee offers practical advice and actionable strategies that can enhance one’s trading journey. By implementing these strategies, traders can potentially improve their trading skills, increase their profits, and minimize their risks.

Recap of key takeaways from the video

One of the key takeaways from Prince Kaybee’s trading video is the importance of having a well-defined trading plan. He emphasizes the need for traders to set clear goals, identify their risk tolerance, and devise a systematic approach to their trading activities. Without a proper plan in place, traders may succumb to impulsive decisions and emotional biases, which can negatively impact their trading outcomes.

Another significant takeaway from the video is the emphasis on risk management. Prince Kaybee highlights the importance of properly managing risk by setting appropriate stop-loss orders and position sizing. By limiting potential losses and preserving capital, traders can safeguard their investments and mitigate the impact of unfavorable market conditions. This approach allows traders to stay in the game even during challenging times and improves their chances of long-term success.

Furthermore, Prince Kaybee stresses the significance of continuous learning and staying updated with market trends and events. He encourages traders to invest time in expanding their knowledge by reading books, attending seminars, and following relevant news sources. By staying informed and adapting to market changes, traders can make more informed decisions and identify profitable trading opportunities.

Implementing the expert strategies shared by Prince Kaybee in his trading video can greatly benefit traders in their journey towards profitability and success. By incorporating these strategies into their trading routine, traders can enhance their decision-making process and increase the likelihood of favorable outcomes.

First and foremost, traders should prioritize the development of a comprehensive trading plan. This plan should outline their trading goals, risk tolerance, and preferred trading style. Additionally, it should include specific rules for entering and exiting trades, as well as guidelines for managing risk. By having a well-defined plan, traders can navigate the markets with more confidence and discipline.

Moreover, traders should prioritize the implementation of effective risk management techniques. This includes setting appropriate stop-loss orders, which will limit potential losses in case a trade does not go as planned. Additionally, traders should determine their position size based on their risk tolerance and the size of their trading account. By keeping risk in check, traders can protect their capital and maintain long-term sustainability.

Furthermore, continuous learning is crucial for traders aiming for consistent success. By dedicating time and effort to expand their knowledge, traders can refine their strategies, identify new trading techniques, and adapt to changing market conditions. The world of trading is dynamic, and staying updated with the latest trends and developments is essential for making informed decisions.

By implementing these expert strategies shared by Prince Kaybee, traders can enhance their trading performance and increase their chances of achieving sustainable profitability. However, it is important to remember that trading involves inherent risks, and success is not guaranteed. Traders must exercise discipline, patience, and perseverance to navigate the markets successfully.

Prince Kaybee’s trading video offers valuable insights and strategies for traders. By implementing these expert strategies into their trading routine, traders can potentially improve their performance and increase their chances of success. Continuous learning, effective risk management, and disciplined decision-making are key components of a successful trading journey. Remember to always stay informed, adapt to market changes, and most importantly, trade responsibly. Good luck on your prince kaybee trading video endeavors!

The prince kaybee trading video provides valuable insights into the world of trading, offering strategies and tips for both beginners and experienced traders. By watching the video, individuals can enhance their understanding of trading concepts and learn how to make informed decisions in the market. Whether one is interested in forex, stocks, or crypto trading, this video serves as a comprehensive resource to maximize trading potential. Unlock new possibilities and stay ahead of the game with the prince kaybee trading video. Start watching today!

News -Discover the Latest AMA official trending video youtube tiktok

The Viral Folding Chair Video – Watch the Mind

Sydney Rallo Car Accident and Its Impact on the Community

Watch the Shocking Jon Romano Sword Attack Video on Viral

Wonka Hugh Grant Oompa Loompa – Iconic Scene Story

Jeff Doucet Autopsy – Examining His Demise

Glowforge Aura Laser – Unleash Creativity with Cutting